Financial Reports in SAP Business One

Welcome to the financial reports topic.

I/ Objectives

We will explore the effect of standard processes in SAP Business One on Financial Reports: such as the Balance Sheet, the Trial Balance, and the Profit and Loss report. We describe when to use each report and how to interpret typical report data.

II/ Business Scenario

Imagine that you are reviewing the Financial Reports with Maria the company accountant of OEC Computers:

Maria mentions that you discussed the influence of Period-End Closing on the Balance Sheet and Profit and Loss reports.

This is because you usually issue the Financial Reports for the last day of each financial year or period to get the financial status of the company.

You demonstrate the financial reports in SAP Business One.

Note that the company usually gets last year’s related documents after the end of the financial year or period. Therefore, they also issue the reports for the closing period, during the following period.

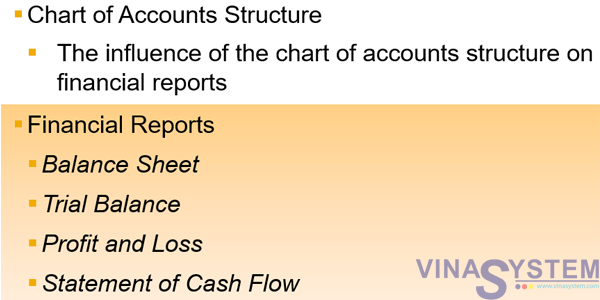

III/ Agenda

We start by talking about the strong connection between the chart of accounts structure and the different financial reports.

1/ Chart of Accounts Structure

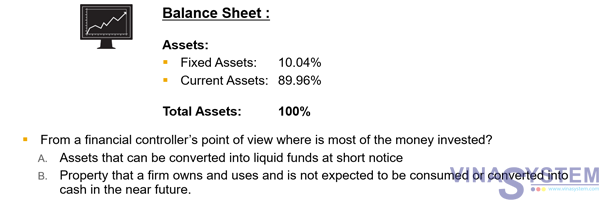

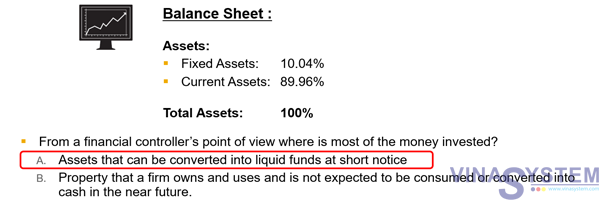

a/ Reflection Question

At the end of the year you issue the Balance Sheet report.

You present the report in a summarized form.

For the Assets Drawer you see the following result.

From a financial controller’s point of view where is most of the money invested?

Are they assets that can be converted into liquid funds at short notice or property that a firm owns and uses that is not expected to be consumed or converted into cash in the near future?

The correct answer is highlighted.

b/ Chart of Accounts Structure

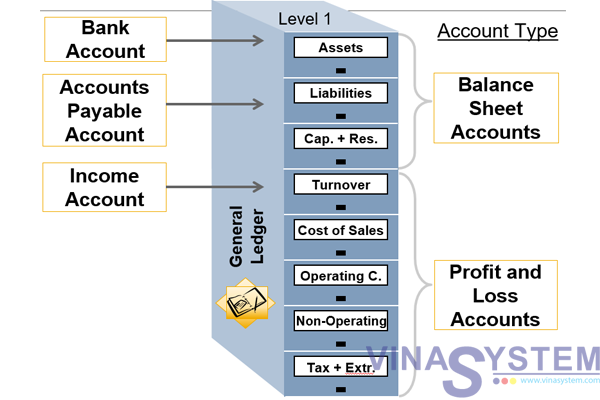

Let us go back and examine the Chart of Accounts Structure in association with Financial Reports.

This subject is discussed in the Chart of Accounts – Concepts topic.

Although the chart of accounts will vary according to a company’s localization, the structures are very similar around the world.

Remember how in the General Ledger you distinguish between Balance Sheet Accounts and Income Statement Accounts, which are also called Profit and Loss Accounts.

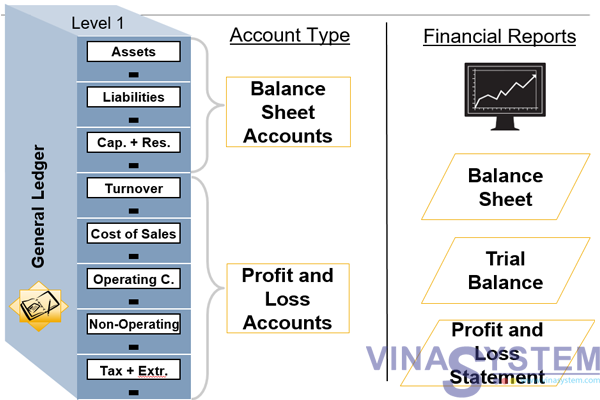

c/ Influence on Financial Reports

The different reports run on the account balances relevant to a selected date or date range and the reports present them according to their drawer, level and type.

For example the balance sheet report is based on the balance sheet accounts, and similarly the profit and loss statement is based on profit and loss accounts. The trial balance shows all the account types.

All these reports are typically issued for the last day of each financial year or period.

Let us look closely on each report:

2/ Financial Reports

All financial reports will appear in the Financials Reports menu which is found in the Financials module

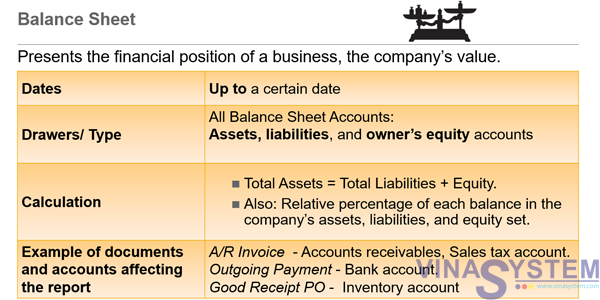

a/ Balance Sheet

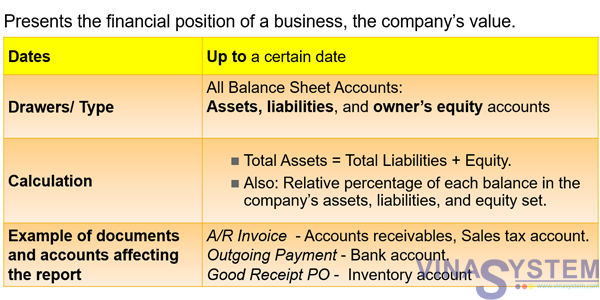

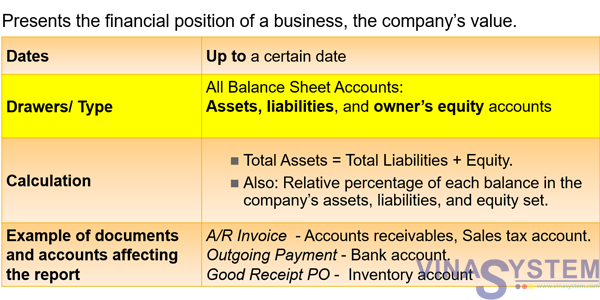

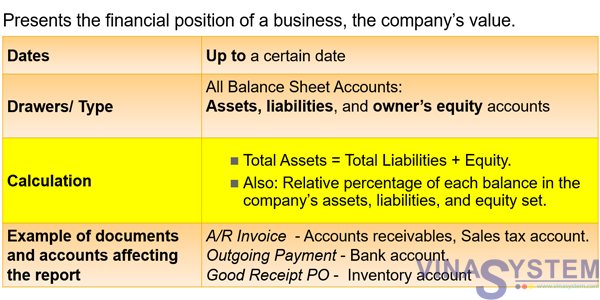

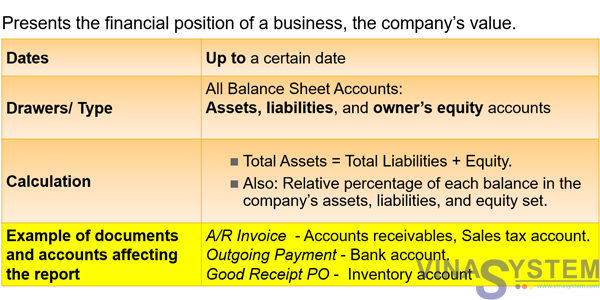

The Balance Sheet presents the financial position of a business, the company’s value.

You run the Balance Sheet up to a certain date, that is from the beginning of the company until that date.

The Balance Sheet presents all Balance Sheet Accounts: Assets, liabilities, and owner’s equity

When you issue the report, the system runs the report on the account balances of the Balance Sheet accounts and summarizes their values according to the formula: Total Assets equals Total Liabilities plus Equity.

In addition, the relative percentage of each balance in the company’s assets, liabilities, and equity is presented.

The equity section includes the profit period. This amount is calculated while the report is being composed, to represent the summary of the profit and loss of the period.

Some examples of documents and their related accounts which affect the report are:

- Accounts receivables and the Sales tax accounts in an A/R Invoice.

- The bank account in an Outgoing Payment, and

- The Inventory account in a Goods Receipt PO.

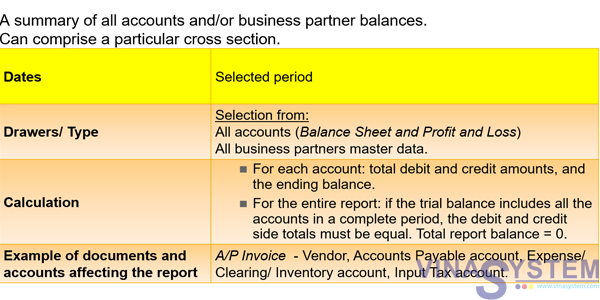

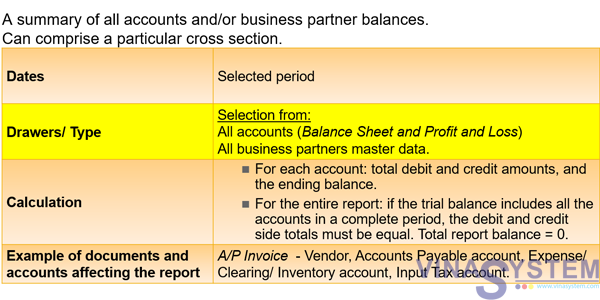

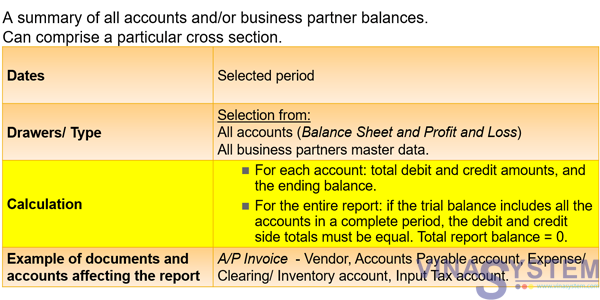

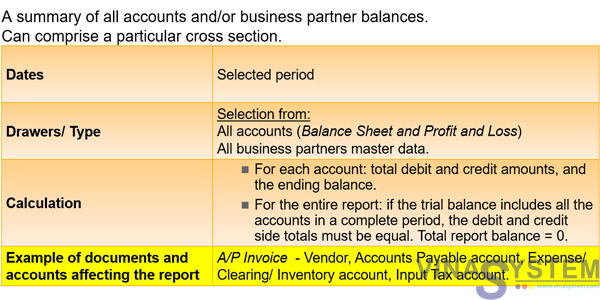

b/ Trial Balance

The Trial Balance displays a summary of all accounts and/or business partner balances. The report can comprise a particular cross section of accounts and business partners.

You can issue the report for a selected posting period or periods.

The Trial Balance presents all selected accounts (Balance Sheet and Profit and Loss) and business partners master data.

If you include business partners in the report, those will be shown at the end, after the list of accounts. The total balance for customers and vendors is represented in the list of accounts, through the control accounts’ balances.

When you issue the report, for each account the system presents the total debit and credit amounts, and the ending balance which is calculated as the debit amount minus the credit amount.

For the entire report: if the trial balance includes all the accounts in a complete period, the debit and credit side totals must be equal. That is, the total report balance should be zero.

Here is an example of a document and its related accounts which affect the trial balance report:

- An A/P Invoice includes the Vendor, the Accounts Payable account, a clearing account or an inventory account, and the Input Tax account.

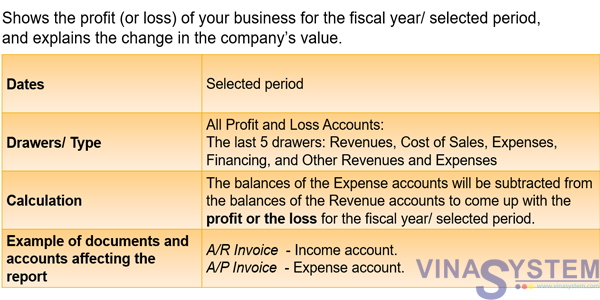

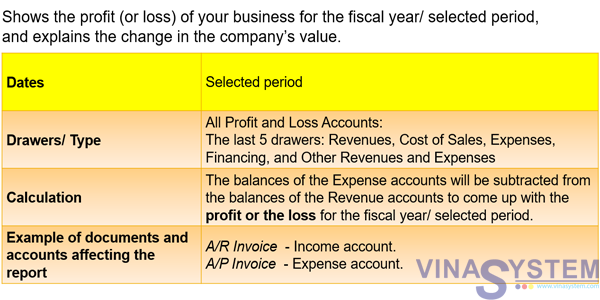

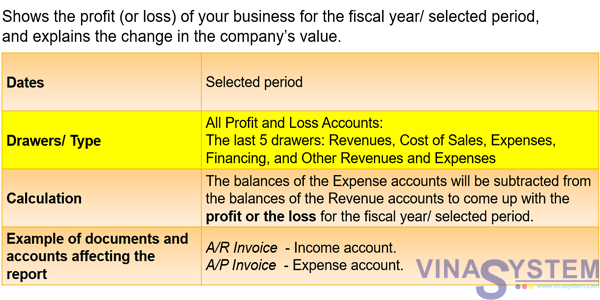

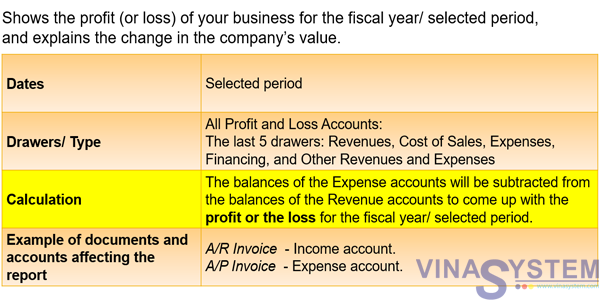

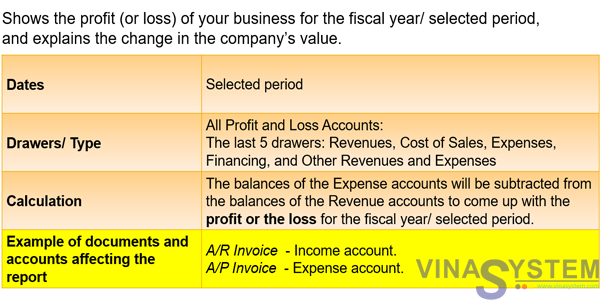

c/ Profit and Loss Statement

The Profit and Loss Statement shows the profit (or loss) of your business for the fiscal year or the selected period. It explains the change in the company’s value.

You run the report for a selected period.

The Profit and Loss Statement presents all the accounts located in the 5 Profit and Loss drawers: Revenues, Cost of Sales, Expenses, Financing and the Other Revenues and Expenses.

When you run the report, the system calculates the profit or the loss for the fiscal year or the selected period according to this calculation: The balances of the Expense accounts will be subtracted from the balances of the Revenue accounts.

And here are some examples of documents and their related accounts which affect the report:

- The income account in an A/R Invoice.

- And the expense account in an A/P Invoice.

3/ Advanced Reflection Question

Here is a question for those of you with accounting backgrounds:

The Balance Sheet calculation is: Total Assets equals Total Liabilities plus Equity.

How is the calculation balanced if the report considers only the Balance Sheet accounts?

* Answer

The profit or loss accumulator is included in the Balance Sheet report and will either increase or decrease the equity on the balance sheet.

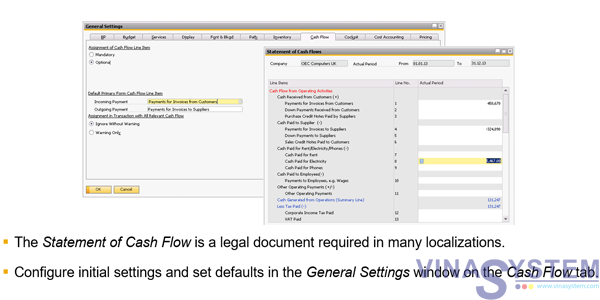

4/ Statement of Cash Flow

The Statement of Cash Flow is a legal document that is required by many localizations – just like the profit and loss and the balance sheet.

You need to configure initial settings in the General Settings window and to set defaults for assigning transactions to relevant items in the Statement of Cash Flow.

For more details on how to configure the Statement of Cash Flow refer to the on-line help.

Note that the Cash Flow is a different report than the Statement of Cash Flow. The Cash Flow report is an internal management tool which is used to help the business manage its cash reserves and to anticipate future periods when it may need to borrow to cover a cash deficit. We will discuss the Cash Flow report in the Cash Management Reports topic.

IV/ Summary

Here are some key points to take away:

- In the General Ledger, you distinguish between Balance Sheet Accounts and Income Statement Accounts, which are also called Profit and Loss Accounts.

- The different financial reports run on the account balances.

- The financial reports present the account balances according to a selected date or range and their drawer, level and type.

- The balance sheet report is based on the balance sheet accounts. It presents the company’s value using the formula: Total Assets = Total Liabilities + Equity. The report displays the relative percentage of each balance.

- The profit and loss statement is based on all profit and loss accounts. It presents the profit or loss of your business. The profit or loss for the selected period equals the difference between the balances of the revenue accounts and the balances of the expense accounts.

- The trial balance is based on all account types. This report presents a summary of all accounts and/or business partner balances. For each account, the report shows the total debit and credit amounts and the ending balance. If the trial balance includes all the accounts in a complete period, the report balance will be zero.